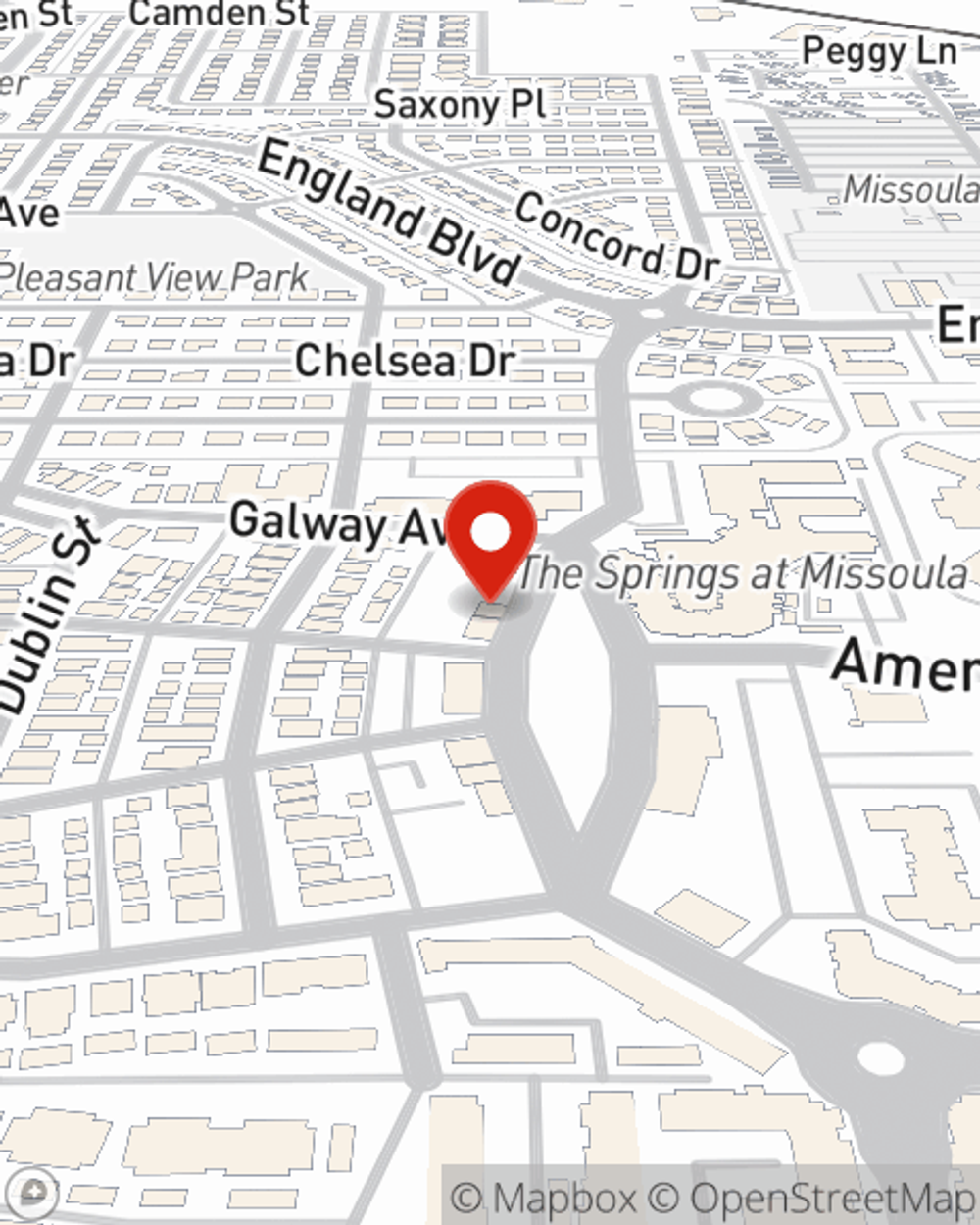

Condo Insurance in and around Missoula

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

- Idaho

- Wyoming

- South Dakota

There’s No Place Like Home

Investing in condo ownership is a big responsibility. You need to consider home layout your future needs and more. But once you find the perfect unit to call home, you also need terrific insurance. Finding the right coverage can help your Missoula unit be a sweet place to call home!

Here's why you need condo unitowners insurance

State Farm can help you with condo insurance

Why Condo Owners In Missoula Choose State Farm

Things do happen. Whether damage from weight of sleet, theft, or other causes, State Farm has excellent options to help you protect your condominium and personal property inside against unpredictable circumstances. Agent Misti Svoboda would love to help you provide you with coverage that is personalized to your needs.

If you're ready to bundle or find out more about State Farm's outstanding condo insurance, get in touch with agent Misti Svoboda today!

Have More Questions About Condo Unitowners Insurance?

Call Misti at (406) 317-7058 or visit our FAQ page.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Misti Svoboda

State Farm® Insurance AgentSimple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.